Photographs of missing children selected by the Center may appear in this publication on pages that would otherwise be blank. The Internal Revenue Service is a proud partner with the National Center for Missing & Exploited Children® (NCMEC). Relief is available for those affected by some disasters. 525, Taxable and Nontaxable Income, for the special tax rules that apply.ĭisaster relief. If you received an option to buy or sell stock or other property as payment for your services, see Pub.

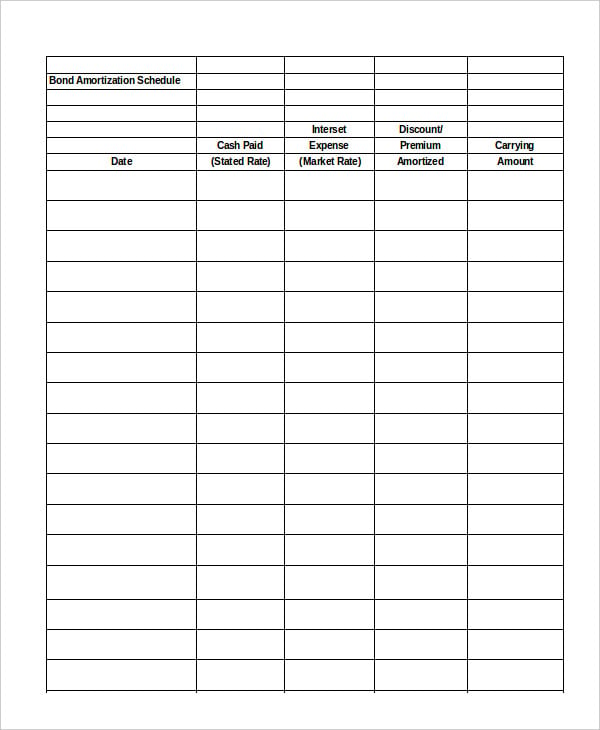

This is true whether you reside inside or outside the United States and whether or not you receive a Form 1099 from the foreign payer.Įmployee stock options. citizen with investment income from sources outside the United States (foreign income), you must report that income on your tax return unless it is exempt by U.S. Pop on over there to learn more about ourWikiand how you can be involved in helping the world invest, better! If you see any issues with this page, please email us at. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors based in the Foolsaurus. When the bond matures, however, there should be no difference at all in the total amount of cash interest, interest expense, or amortization between the two methods for the same bond.

Conversely, the effective interest method results in more amortization in later years than the straight line method. Knowing this, you'll notice that the straight line method will result in more discount or premium amortization during earlier years than the effective interest method. The only thing that doesn't change from year to year is the amount of cash interest paid on the bond. The effective interest method results in a different amount of interest expense and amortization each year.

0 kommentar(er)

0 kommentar(er)